Chapter 12 Knowledge Management.

Knowledge Management

The traditional view of knowledge management has treated knowledge in terms of prepackaged or taken-for-granted interpretations of information. However, this static and contextual knowledge works against the generation of multiple and contradictory viewpoints that are necessary for meeting the challenge posed by wicked environments. - Dr. Yogesh Malhotra inToward a Knowledge Ecology for Organizational White-Waters

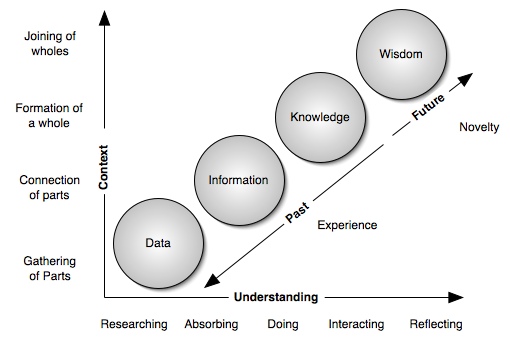

Data is organized into information by combining data with prior knowledge and the person's self-system to create a knowledge or mental representation (Marzano, 1998). This is normally done to solve a problem or make sense of a phenomenon.

This knowledge representation is consistently changing as we receive new inputs, such as new learnings, feelings, and experiences. This causes the knowledge representation to change due to our brains being branched or interconnected to other representations, rather than layered.

Knowledge Management Comes Quite Naturally to Humans

While there are normally only five ways to organize information — LATCH (Location, Alphabet, Time, Category, or Hierarchy), these five ways have a lot of versatility (Wurman, 2001). For example, a youngster with a toy car collection may sort them by color, make, type, size, type of play, or a dozen other divisions. The youngster can even make up categories as new divisions, play activities, or wants appear. However, a computer is considered "intelligent" if it can sort a collection into one category. Yet, many organizations are placing their bets on computer systems due to the amount of data such systems can hold and the speed at which it can sort and distribute once such categories and data are made known to it.

Extracting Knowledge

Jeffery Pfeffer and Robert Sutton (2000) write that companies have wasted hundreds of millions on worthless knowledge management systems:

- The most valuable employees often have the greatest disdain for knowledge management. Curators badger these employees to enter what they know into the system, even though few people will ever use the information.

- The managers of these systems know a lot about technology, but little about how people actually use knowledge on the job.

- Tacit knowledge is extremely difficult to capture into these systems, yet it is more critical to task performance than explicit knowledge.

- Knowledge is of little use unless it is turned into products, services, innovations, or process improvements.

- Knowledge management systems work best when the people who generate the knowledge, are the same people who store it, explain it to others, and coach them as they try to implement it. These systems must be managed by the people who are implementing what is known, not those who understand information technology.

Next Step

Click on the various parts of the chart to learn more about that topic

Reference

Marzano, Robert J. (1998). A Theory-Based Meta-Analysis of Research on Instruction. Mid-continent Aurora, Colorado: Regional Educational Laboratory. Retrieved May 2, 2000 fromhttp://www.mcrel.org/products/learning/meta.pdf

Pfeffer, J., Sutton, R. (2000). The Knowing—Doing Gap: How Smart Companies Turn Knowledge into Action. Cambridge, MA: Harvard Business School Press

Wurman, S. (2001). Information Anxiety 2 Indianapolis: Que.

B r a n d s t r a t e g y

> B U I L D I N G A W I N N I N G B R A N D P O R T F O L I O C E N T R E D A R O U N D H E I N E K E N

Our brand strategy is to build a strong portfolio that combines the power of local and international

brands and which has Heineken at its centre. The consistent growth of our brands requires solid

creative brand management, which we coordinate centrally. By carefully balancing our brand portfolios and achieving optimal distribution and coverage, we aim to build and sustain strong positions in

local markets.

For the Heineken and Amstel brands, we develop and maintain central guidelines and standards for

brand style, brand value and brand development. At a central level we also support local management

of the entire brand portfolios, through benchmarking programmes designed to optimise marketing,

sales and distribution.

C o m m e r c i a l E x c e l l e n c e

> O R G A N I C G R O W T H I S C R I T I C A L F O R T H E F U T U R E O F O U R B U S I N E S S

In 2004 we launched a global strategic initiative – ‘Building Winning Portfolios!’. This long-term

initiative is aimed at systematically reviewing and improving the strength of portfolios in a number

of key markets and identifying those brands, that create value. Where unmet consumer needs are

identified, we are accelerating the introduction of new, consumer-relevant brand propositions.

In 2005 we will have completed reviews across the majority of key markets. In parallel, there is also a

strong focus on building the excellence required in sales and marketing to execute the portfolio plans.

To leverage our global strength and to accellerate organic growth we made good progress in

optimising operating companies’ commercial policies. We did this through sharing knowledge and

experience and developing excellent brand and portfolio management skills alongside world-class

channel, sales and distribution processes. Measuring and monitoring how well we are performing

is critical to success. Given this, we paid special attention in 2004 to improving the effectiveness

of commercial spend. The result will be reallocations of commercial spend, increased return on

commercial investment and finally, performance improvement and value creation.

In addition, we introduced a global standard for measuring brand performance. This ‘Heineken

Brand Dashboard’, is a new system for measuring and reporting all essential key performance

indicators on sales, marketing and finance relating to the Heineken brand. This tool will make it easier

to diagnose brand health issues and to have a consistent view of the most successful growth drivers for

the Heineken brand across the business. Further extensions of the ‘dashboard’ to track and manage

other brands in the same way are planned in 2005.

At the end of 2004, our most senior commercial managers exchanged ideas and received

demonstrations of best practice at a two-day workshop – ‘Impact 2005’. These two days resulted in a

common understanding of the goals and priorities as well as in concrete plans to leverage our

portfolio strength in all our key markets. It is an indication of how we intend to operate and build our

capability in the future.

Brands

In 2004, our total beer volume was made up as follows: Heineken brand 18.7%, Amstel 9.1% and other

beer brands 72.2%. In addition to Heineken and Amstel, our international brands comprise a collection

of specialty beers to satisfy the consumer’s growing demand for variety. Sales of these high margin

products allow us to drive improvement in the sales mix.

H e i n e k e n

> T H E W O R L D ’ S M O S T VA L U A B L E I N T E R N AT I O N A L P R E M I U M B E E R B R A N D

Heineken is Europe’s leading beer brand and is the world’s most valuable international premium

beer brand. In 2004, the Heineken brand once again reinforced its position in virtually all markets.

Sales of Heineken beer worldwide increased 3.1% to 22.8 million hectolitres.

The strongest growth markets in Europe for Heineken in 2004 were Russia, Poland and Spain. In the

more established European markets – France, Italy, the Netherlands, Ireland and Greece – Heineken

was able to maintain or strengthen its position. In the United Kingdom, where the brand was

withdrawn and fully re-launched early 2003, it continues to achieve growth in volume and distribution.

With new business structures and dramatically improved distribution in Central and Eastern Europe,

the brand was able to make good progress across the region, including a move to production in

Romania in December, a highly successful relaunch in Austria and strong growth throughout the year

in Poland.

Strong growth was also achieved in several markets in the Asia Pacific region, particularly Vietnam,

New Zealand and Taiwan. In China, thanks to our new local production strategy and increased focus,

we saw a substantial improvement compared with 2003, which was a difficult year. In August,

Heineken’s position in Australia was strengthened through a sales and marketing joint-venture with

Lion Nathan, Australia’s second-largest brewer.

In South America, Heineken achieved strong volume growth in Chile and Argentina and also grew

in Puerto Rico. In North America, USA and Canada, we accomplished another year of growth.

In Heineken’s main markets in Africa, the Heineken brand continued to perform well. Brandhouse,

the new joint-venture with Diageo and Namibia Breweries, is supporting growth in South Africa, and

will be an important platform for future growth. South Africa saw strong brand growth during the

year. In Nigeria, we began local production of the Heineken brand following a long ban on imported

beers.

I n n o v a t i o n , R e s e a r c h & D e v e l o p m e n t

To a large degree, the ability of Heineken to sustain growth depends on our ability to innovate across

products, packaging and drinking occasions. It is our understanding of the consumer, which shapes

our innovation ideas and it is world-class Research & Development (R&D) which enables those ideas

to be realised.

Much of our R&D activity is carried out locally in our operating companies and coordinated centrally.

The programme covers the entire supply chain, from the evaluation of new and improved strains of

barley and hops to the development of new products and packaging.

An important focus of our R&D efforts is on developing and refining new draught beer systems,

both for the on- and off-trade. In February 2004 we launched BeerTender® in the Netherlands,

a returnable 4-litre keg and tap system that allows consumers to enjoy quality draught beer at home.

Based on its successful launch, we now plan to introduce BeerTender® in a number of other countries.

We also continue to work on improvements to the features and functionality of David, our successful

draught beer system for small on-trade outlets, launched in 2002.

Packaging innovations in 2004 included the further roll-out of the Heineken ‘Identity’ can. Across

markets, in which the can has been launched, results have confirmed success in terms of positive

consumer perception, premium positioning and volume growth. Through the year, we also created

I nv e s t o r R e l a t i o n s

new designs for secondary packaging for Heineken and Amstel.

Heineken takes a proactive role in maintaining an open dialogue with shareholders and bondholders,

providing accurate and complete information in a timely and consistent way. We do this through

presentations, webcasts, press releases, regular briefings and open days with analysts, fund

managers and shareholder associations.

In 2004, we gave several business and financial presentations and improved audience access by

webcasting them live from London and New York. One of these presentations was directed solely

at sustainable investment portfolio managers. In addition, Heineken took part in a number of international conferences organised by third parties and other activities for institutional investors.

For retail investors, who are mainly based in the Netherlands, Heineken organised company visits

and gave presentations. In 2005 we plan to increase the number of direct webcasts and presentations

to analysts and fund managers.

To improve further our dialogue with financial audiences we make significant and increasing use

of the website www.heinekeninternational.com

S u s t a i n a b i l i t y

As a company we aim to achieve more than just superior financial results. We are committed

to sustainability in the broadest sense. Our definition covers economic sustainability, the working

conditions and general health, safety and well-being of our employees and the support of the local

communities in which we operate. Sustainability covers everything from the quality of our products

to protecting the environment. We expect to be judged on all these elements and we invest great time

and resources in meeting our ever-rising standards and targets.

Sustainability reporting

In 2004 we published the first comprehensive Sustainability Report. This publication ‘Towards

Sustainability’ analyses the period 2002-2003, presenting a thorough and broad overview of our

activities worldwide and how they score according to three dimensions of sustainability: economy,

ecology and society.

ไม่มีความคิดเห็น:

แสดงความคิดเห็น